Fintiera Bank Statement Cockpit facilitates the automation of import processes and bank statement postings.

Benefits

- Automatic booking of bank statements in MT940 and PDF format

- Consistency of import and accounting processes

- Higher effectiveness of organizations with one or more banks and having any number of subsidiaries

- Generating a large volume of banking transactions.

- Time – significant reduction of time needed to obtain and post bank statements with automation of bank transaction postings of up to 100% for outflows ordered from SAP and 70-90% for inflows

- Completeness of information – a report presenting details and statistics of imported data from statements

- Standardization – Fintiera Bank Statement Cockpit systematizes banking formats, reducing them to a common format comprehensible to SAP

- Consistency – unification of banking transaction posting schemes across the whole organization

- Flexibility – easy expansion of automatic transaction posting templates

- Easier and faster access to information – a single point of direct access in SAP to information obtained from the bank even before the full posting of bank statements.

Differences from the competitors:

- Functions of many SAP transactions in a single cockpit

- Guaranteed stability of the solution

- Ease of maintenance

- Flexibility of permission and configuration management

- Integration with other Fintiera solutions

- Operating on both SAP ERP and S/4 Hana

- Easy work monitoring

- High level of security of processed data

- Time savings obtained by process execution using a single product

- Current and complete information

- Ease of further development at the Customer’s site in the future.

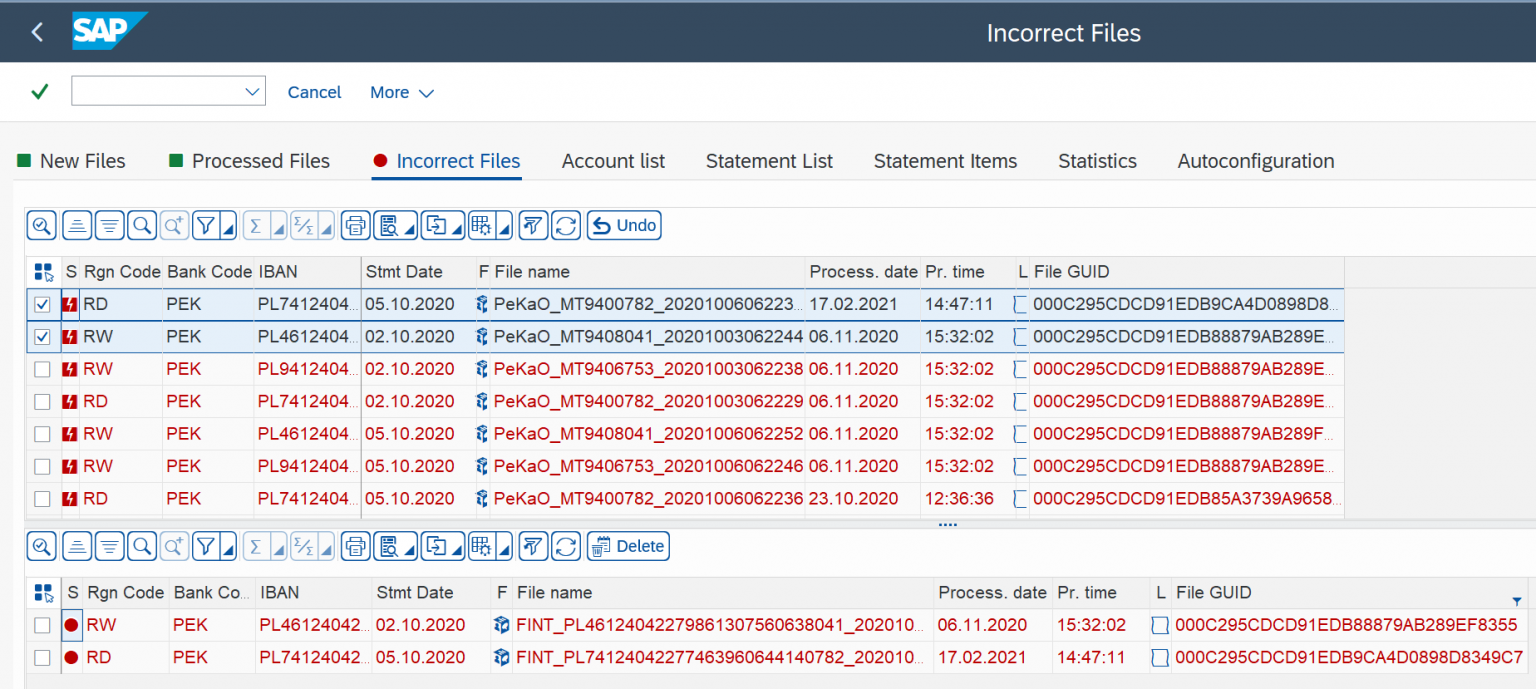

- Mechanism of automatic import of bank statements in MT940 and PDF formats from a network location to SAP

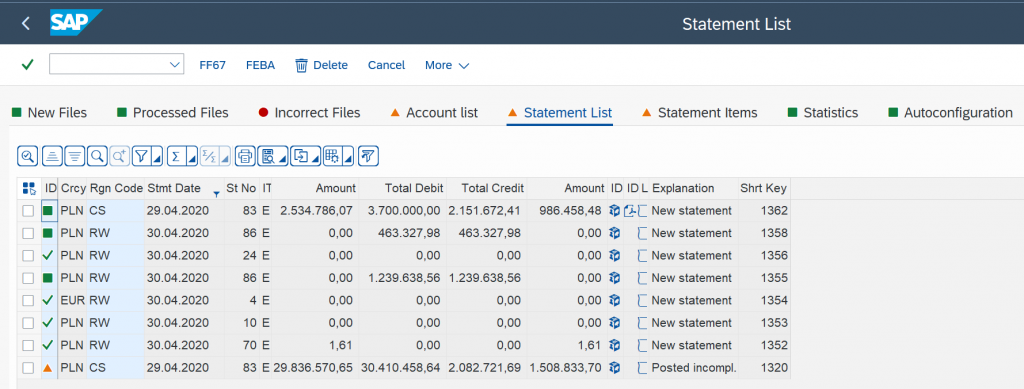

- Ability to present imported statements with a PDF preview option and account assignment statistics

- Providing key users/administrators with mechanisms to configure automatic posting rules and templates

- Providing key users/administrators with a secure function for deleting statements with verification of the prior reversal of items

- Automated posting of outflows ordered from SAP and repetitive inflows based on configurable transaction search patterns and the development of additional account assignment rules for items (e.g. CC filling)

Ability to classify accounts according to any dimension (depending on the company needs) - Standardization of MT940 files from different banks to a unified format

- Automatic import of statements from network folders into the SAP system Full use of standard features, such as dictionaries, algorithms and search patterns, to properly post statement items as well as to pair and to settle them with other documents entered into the SAP system

- Additional criteria that can be assigned in the search patterns, such as the counterparty’s account number or type of operation, which will increase the flexibility of automation of statement item postings

- Automatic account assignment and the ability to extract more information (such as the counterparty’s data or the name of the bank transaction) from the statement item thanks to standardization

- Displaying all information related to statement items in a single cockpit

- Ability to edit the statement in the cockpit.

- Technically, the solution is available for every Customer using SAP S/4 HANA or SAP ERP 6.0 with an active SAP NetWeaver component, version 7.40 as a minimum.

How we work:

A typical process of implementation of our solutions includes the following phases:

Analysis – a review of the process of importing bank statement transactions and posting them in SAP, currently in use in the Company. Development of the target process and identification of key rules requiring automation.

The deliverable of this stage will be the Small Business Blueprint (SBB).

Realization – system implementation of assumptions resulting from the SBB, including programming and configuration work, internal and acceptance tests, solution documentation and go live.

Support / Finetuning – support for users at the initial stage of production solution operation and customizations in the rules of automatic posting of bank statements for cases not identified at the analysis and realization stages.

Need more information? Write or call us

+48 577 600 134