Fintiera Liquidity Cockpit is a tool that streamlines cash position and liquidity management in SAP ECC i SAP S/4 HANA.

Fintiera Liquidity Cockpit is another solution from Fintiera that improves the efficiency of SAP ECC and SAP S/4 HANA system.

Users of the reports are both operational and management divison of departments responsible for liquidity management in an organization operating on SAP, especially large enterprises and extended capital groups.

Benefits

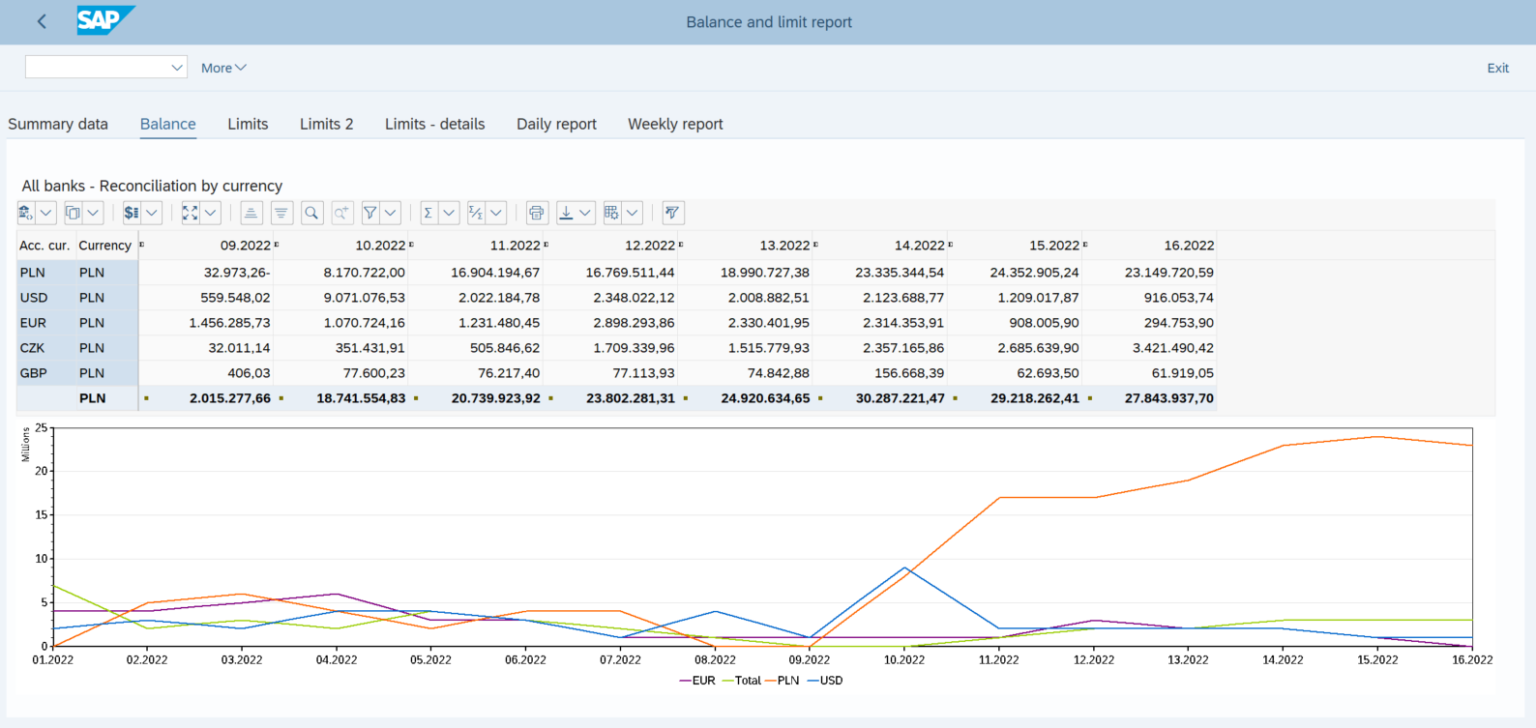

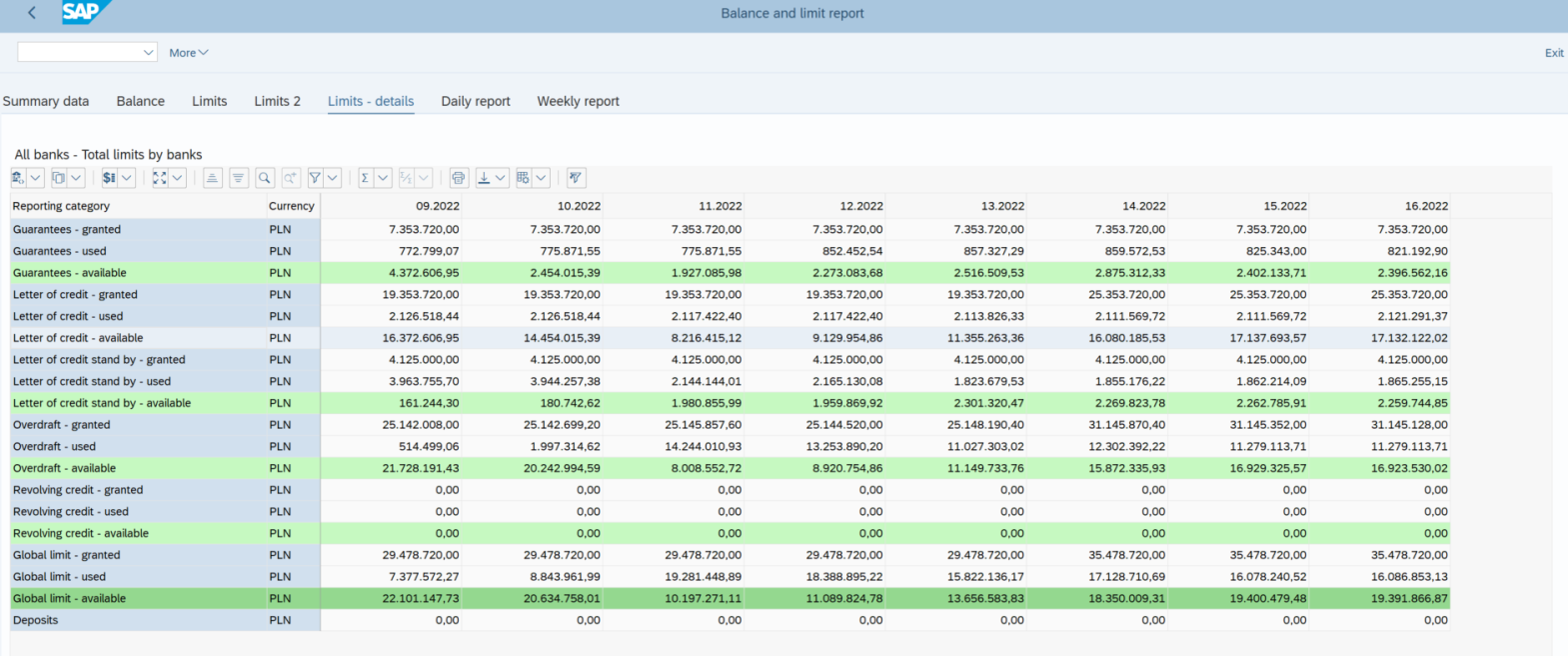

The tool is designed to monitor the current balance of funds and the use of limits in various currencies, banks and companies, as well as to report on the performance and forecast of cash flow over any time horizon. In addition, it enables automatic emailing of a ready-made report to decision-makers containing key liquidity information. The solution is highly configurable. The client defines any categories of data presentation, according to business needs, and the way they are presented in reports. In addition, the customer himself can manage categories, report layouts, or charts.

- Time and reliability of information – a significant reduction in the time required to obtain reliable information on the liquidity situation of the organization (surplus and storage of funds)

- Completeness of data – reporting on balances of funds and investments , debt status and use of credit limits cash flow forecast and execution

- Timeliness of balances – Always up-to-date information about the state of funds thanks to the possibility of direct communication with banks

- Process standardization – use of mechanisms to standardize liquidity management processes across the company/ group

- Transparency and multidimensionality – the tool focuses on what is important to the user and presents it clearly in different dimensions

- Flexible access – direct access to the cockpit from the SAP GUI and the SAP Fiori application (web browser)

- Tailor-made solution – proprietary reporting engine allowing flexible configuration of complex data views and charts.

Differences from the competitors:

- Flexibility to create extensive liquidity reports with charts tailored to the business needs of large organizations

- Advanced handling of credit limits handling the specifics of various credit products based on limits operating in the banking market (overdraft, factoring, revolving credit, guarantees, letters of credit)

- Direct communication with the bank support for updating intraday balances through WebService communication with the bank, which can serve as a hub for data obtained from other institutions

- Versatility and scalability the possibility to use the tool as a central TMS (Treasury Management System) class system for liquidity management in the capital group, also in terms of subsidiaries that do not use the SAP system

- Expert implementation support solution implementation supervised by product architects with many years of experience in the implementation of liquidity management processes in SAP, familiar with the specifics of the domestic banking sector

- Post-implementation administration the ability for the customer to manage the solution on an ongoing basis after the production launch.

- Coherent solution integrating various sources of liquidity data supported by comprehensive credit limit handling

- Support for various methods of reading bank balances: Manual entry, import from MT940 and MT942 statements, or direct balance inquiry from the bank via WebService channel

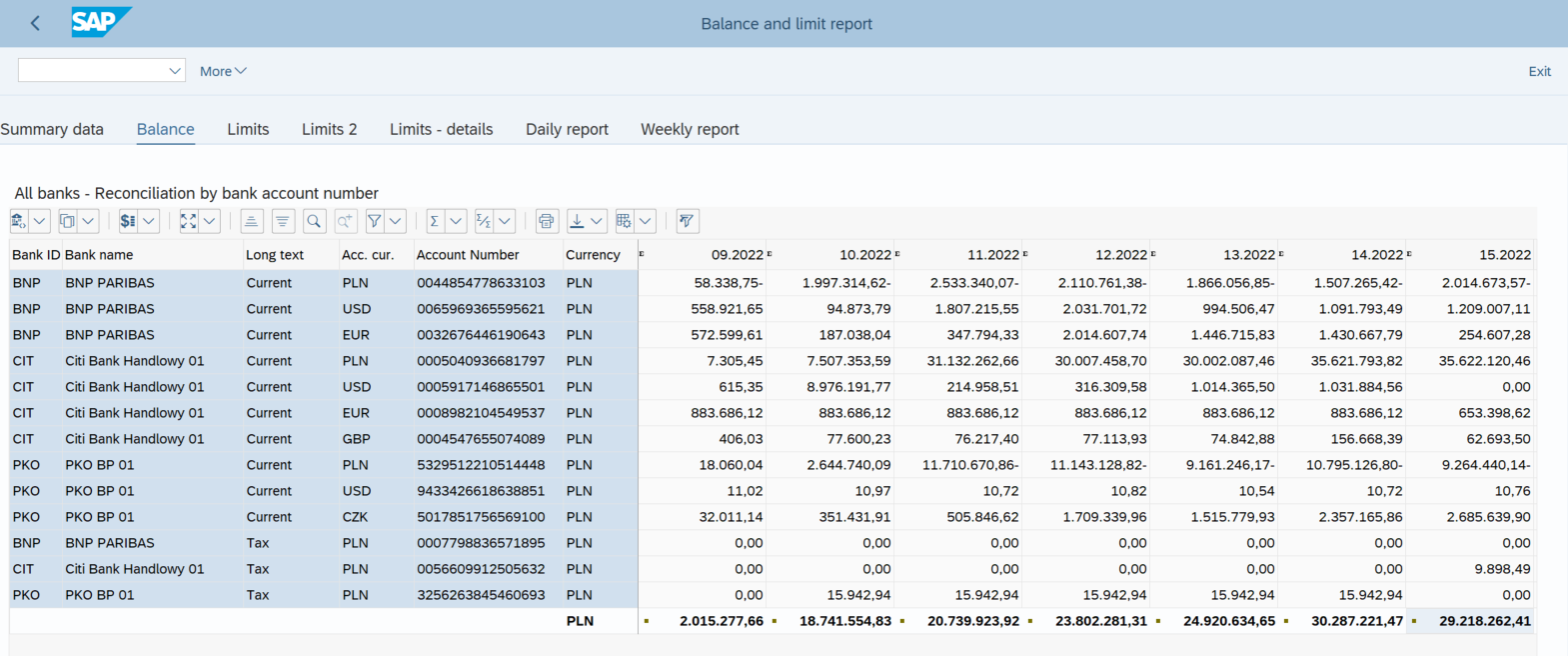

- Multiplicity of reporting dimensions to meet the needs of large national organizations and transnational corporations

- Scalability of the solution in terms of building a complex hierarchical cash flow model

- Ease of configuration of data views and charts within the intended model.

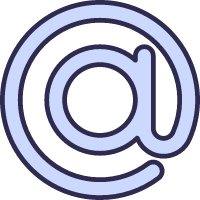

- Balance reporting: current or opening balances per account, currency, account type, bank and country, including overdraft limits

- Forecast of closing balances per currency including overdraft limits

- Presentation of debt status by type of obligation and bank, including limits

- Liquidity indicators such as projected closing balance in the horizon of a week, month per currency, country, company

- Currency gap charts with changeable horizon and snapshot (daily, weekly, mothly) for defined significant currencies

- Forecast cash flow according to different dimensions and in any complex, hierarchical structure of cash flow

- Data feeds possible through dedicated form factors.

- Technically the solution is available to any customer using SAP S/4 HANA version at least 1610

- For the application of the solution in groups of companies and some functionalities, it may be necessary to have a license of SAP S/4 HANA Finance for Cash Management

- In the case of a WebService connection with a specific bank, an agreement between the customer and the bank for the use of such service is required.

Need more information? Write or call us

+48 577 600 134